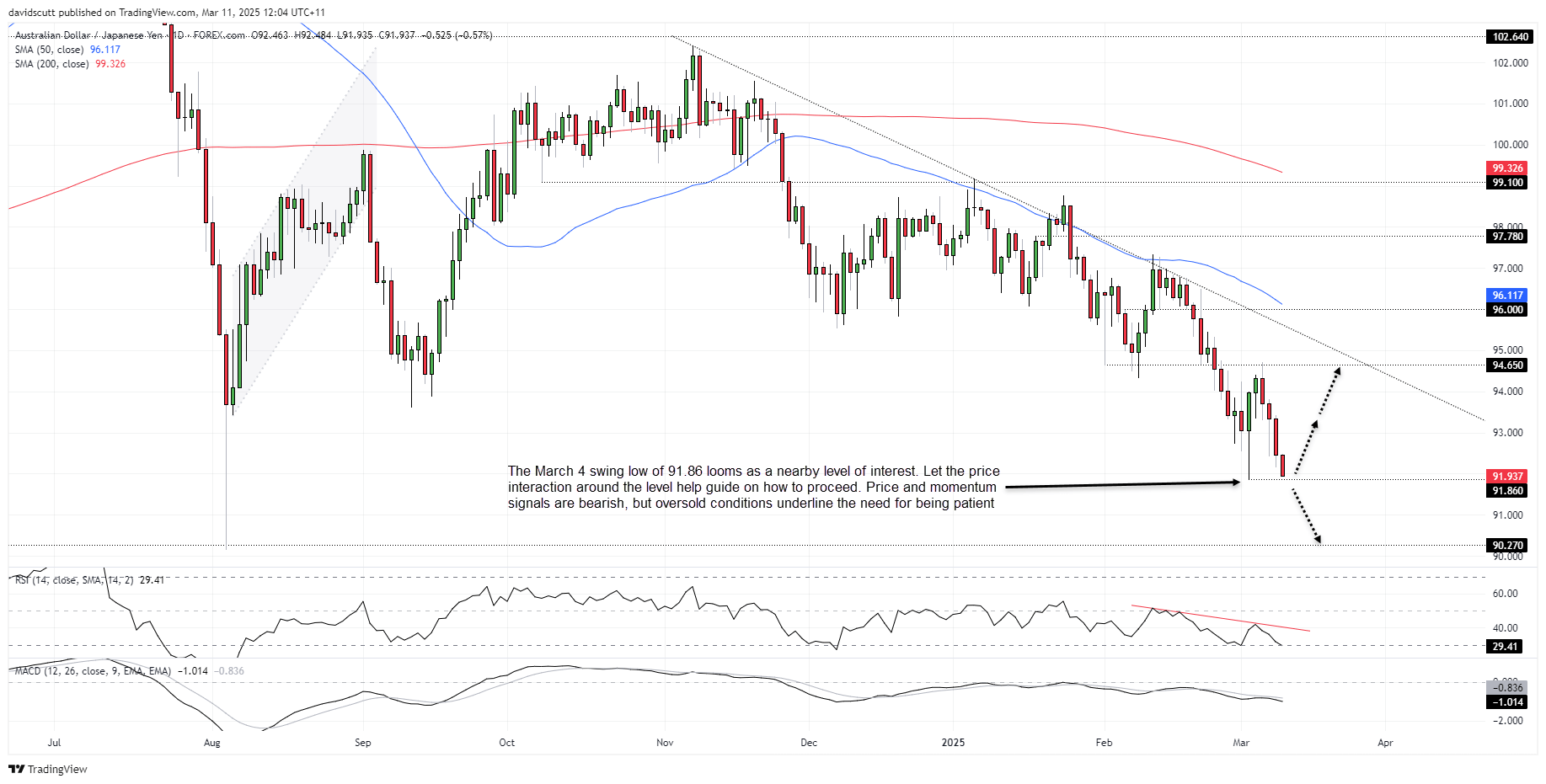

AUD/JPY exams March 4 low, with a break beneath 91.86 opening room for 90.27.

RSI alerts oversold situations, elevating the chance of a countertrend squeeze.

Australia’s and are each considered economically delicate markets, closely uncovered to shifts in investor threat urge for food. So, it’s hardly a shocker that each are below the pump within the present macro minefield. U.S. recession fears have slammed into stretched asset valuations, triggering a pointy unwind from ranges seen simply weeks in the past.

Whereas value and momentum alerts proceed to favour draw back in and AUD/JPY, merchants have to be alert to the chance of sharp countertrend rallies with each sitting in oversold territory. Brief-covering and opportunistic dip-buying might see abrupt squeezes, particularly if sentiment stabilises. Look ahead to apparent reversal alerts to information your selections.

ASX 200 Bears Eye Bigger Unwind

Bears tore by means of the October 2022 uptrend in ASX 200 SPI futures like a sizzling knife by means of butter, slicing by means of with ease after disposing of the 200DMA days earlier. A half-hearted try to reclaim the uptrend on Monday was swiftly rejected, paving the best way for an additional exaggerated decline that kicked off within the in a single day session and has spilled into Tuesday.

Supply: TradingView

The worth is now wedged between minor helps at 7860 and 7796—the latter being the final notable degree earlier than 7600, the place consumers stepped in all through a lot of 2024. RSI (14) and MACD are flashing bearish alerts, however with RSI now oversold on the day by day timeframe, the percentages of a squeeze are creeping increased. A little bit of persistence could go a great distance right here.

If we had been to see a sustained push beneath 7796, merchants might look to promote the bread, concentrating on a transfer to 7600. A cease may very well be positioned above 7796 for cover towards reversal.

Alternatively, if 7796 had been to carry, search for a bottoming sign on timeframes of in the future or much less. If one had been to current itself, it might permit for longs to be established, on the lookout for a countertrend squeeze. Monday’s low of 7925 screens is one attainable goal. A cease beneath 7796 would shield towards a continuation of the bearish development.

AUD/JPY Assessments March Swing Low

Supply: TradingView

AUD/JPY is testing the March 4 low of 91.86 halfway by means of the Asian session, persevering with the fast unwind that started after sellers shut the door at 94.65, abandoning a key bearish reversal candle. The most recent drawdown has shoved RSI (14) into oversold territory on the day by day, although each it and MACD stay firmly bearish. Whereas a squeeze threat is constructing, that alone isn’t a ok motive to leap ship with out an apparent bottoming sign.

A sustained break of 91.86 would create a bearish setup, permitting for shorts to be established beneath with a cease above for cover. 90.27 screens as one potential goal.

If 91.86 had been to proceed to carry, merchants might flip the setup, establishing longs above with a cease beneath for cover. Some resistance could also be encountered round 93.40, though 94.65 comes throughout as a extra applicable goal.

Authentic Publish