Trump’s deliberate tariff will increase are so silly and wantonly harmful I discover it tough to put in writing about it. Luckily, loads of others are sounding alarms concerning the scale of the pending devastation.

As you most likely know, April 2 is when Trump plans to unwrap the small print of what quantities to an financial teardown plan on a worldwide scale. This can be very tough to fathom what he intends to perform save display the extent of his energy. However even historic archetype of destruction had causes. The dreaded Kali, along with her necklace of skulls, saved herself busy killing demons different gods had let free. She apparently additionally has stunning manners. The Furies are forces for justice, albeit typically applied brutally. From Wikipedia:

The Erinyes stay in Erebus and are extra historic than any of the Olympian deities. Their process is to listen to complaints introduced by mortals towards the insolence of the younger to the aged, of kids to oldsters, of hosts to company, and of owners or metropolis councils to suppliants—and to punish such crimes by hounding culprits relentlessly.

After all, these two legendary examples are feminine, and it appears odd that commentators are loath to depict Trump’s excessive emotionality and fickleness at stereotypically female.

A a lot much less grand/grandiose picture is Dr. Jekyll and Mr. Hyde, notably since Trump may be charming. Nevertheless, in a current discuss on Dialogue Works, John Helmer talked about that Russian officers have taken be aware of the parallel…and that within the Robert Louis Stevenson novel, Mr. Hyde turns into dominant.

Since we are able to avert our eyes from the principle occasion just for so lengthy, we’ll begin with the Wall Road Journal. When the Wall Road Journal editorial board is a voice of sanity, you realize it’s unhealthy. Key bits:

Monetary markets have the shakes as President Trump prepares to launch his subsequent massive tariff salvo on Wednesday. And nerves are applicable since Mr. Trump’s chief commerce adviser, Peter Navarro, is boasting about what he says will quantity to a $6 trillion tax enhance from the tariffs….

George Orwell, name your workplace. In the actual financial world, a tariff is a tax. When you elevate $600 billion extra a 12 months in income for the federal authorities, you’re taking that quantity away from people and companies within the personal financial system.

By any definition that may be a tax enhance, and the $600 billion determine can be one of many largest in U.S. historical past. It quantities to about 2% of gross home product, and it will take the federal tax share of GDP above 19%. The common since 1975 is about 17.3%….

It’s attainable Mr. Trump will stroll again from this tax ledge…

However what is evident is that the President goes to impose important tariffs, and achieve this when the financial system is slowing. The Atlanta Federal Reserve’s GDP Now estimate for the primary quarter, which ended Monday, has the financial system shrinking 0.5%. That unstable quantity will change as March information arrive, however each customers and companies have grown extra cautious as they fear concerning the impact of tariffs.

That is particularly worrying as a result of the indicators are that Mr. Trump thinks tariffs are definitely worth the financial injury. The newest proof is his weekend declare that he doesn’t give a hoot if costs rise on overseas vehicles….

Someway we doubt American customers will really feel the identical at a seller showroom. Mr. Trump’s 25% tariff on overseas vehicles, which matches into impact this week, will elevate automobile costs by some quantity. Overseas automobile makers may take up a number of the tariff value, however some a part of the 25% levy is bound to be handed on to American customers.

Mr. Trump additionally ignores that U.S. automobile makers are additionally more likely to elevate their costs…over time the usfirms can be silly to not elevate their costs to extend income, maybe by some margin lower than the rise on imported vehicles.

That’s what occurred after Mr. Trump raised tariffs on washing machines in his first time period. Washer costs rose practically 12%, in line with a 2019 examine, and it didn’t matter the place the machine was made.

Admittedly, the Journal harps on their favourite soiled phrase, “tax”. The article additionally assumes that automobile parts shipped from Canada and Mexico as a part of “American vehicles” will stay exempt, per aid the Administration settled on in early March. The US automaking enterprise is built-in throughout the three nations, with many border crossings required. It might be an operational in addition to monetary nightmare to implement tariffs on Canadian and Mexican components. However the unstable Trump may flip flop once more, or threaten to, which might wreak havoc with planning.

From one other level within the ideological spectrum, right here, the Guardian:

A full-blown commerce warfare between the US and its buying and selling companions may value $1.4tn, a brand new report reveals.

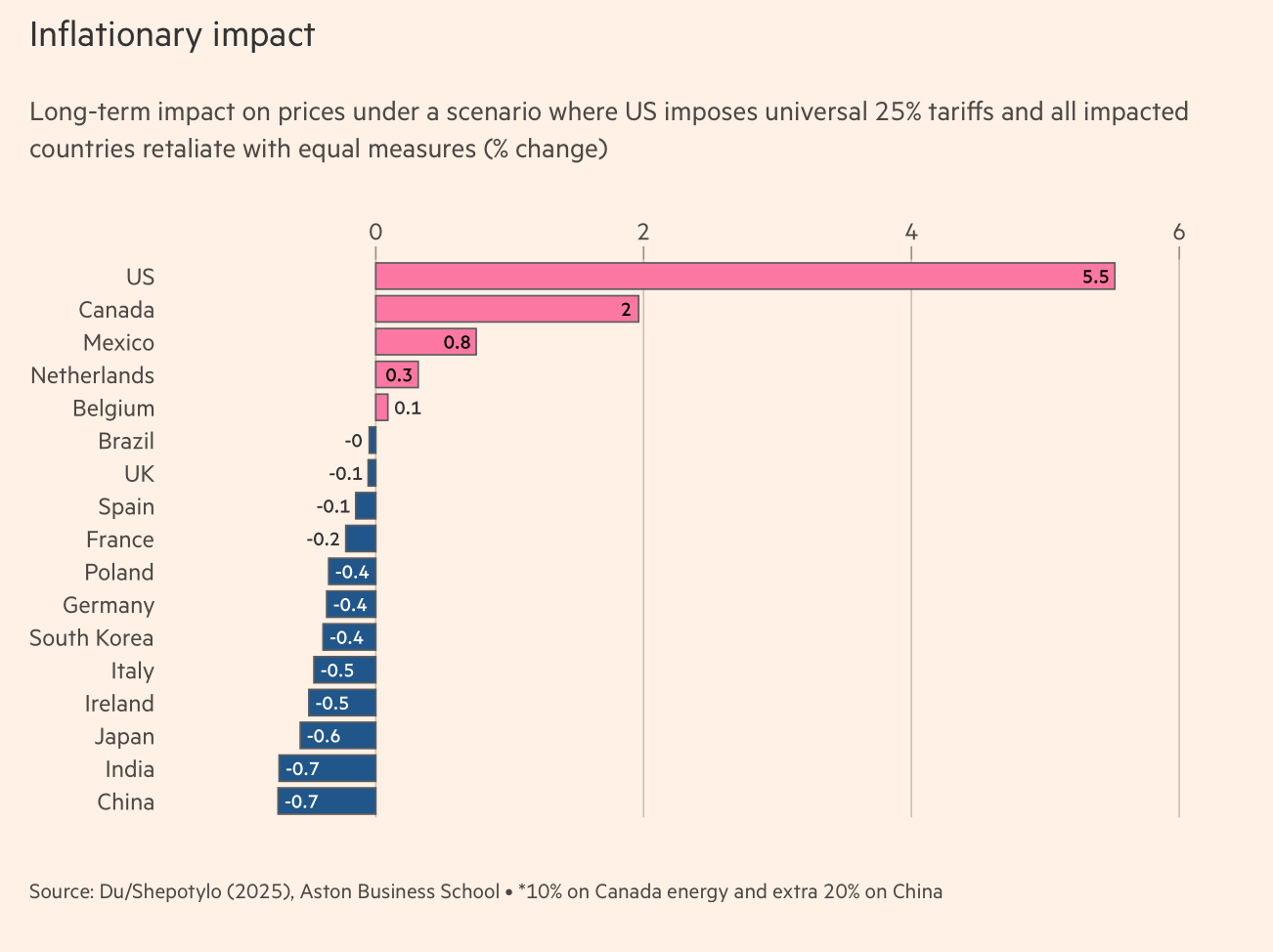

Economists at Aston Enterprise College have modelled a variety of potential situations, together with the likelihood that America it hit by full world retaliation after it pronounces new tariffs towards different nations.

That full-scale commerce battle may end in a $1.4 trillion world welfare loss, Aston has calculated.

The report explains that tariff escalation results in larger costs, diminished competitiveness, and fragmented provide chains, as we noticed in 2018 within the US-China commerce warfare.

It says:

Donald Trump’s 2025 return to energy has unleashed a gale of protectionism, reshaping world commerce inside weeks.

They define six situations, from the primary wave of tariffs already introduced towards Canada, Mexico and China to a full-blown commerce warfare.

Listed below are the important thing findings:

US preliminary tariffs: US costs rise 2.7% and actual GPD per capita declines 0.9%. Welfare declines in Canada by 3.2% and Mexico by 5%.

Retaliation by Canada, Mexico and China: US loss deepens to 1.1%, welfare declines in Canada by 5.1% and Mexico by 7.1%.

US imposes 25% tariffs on EU items: Sharp transatlantic commerce contraction, EU manufacturing disruptions, US welfare declines 1.5%.

EU retaliates with 25% tariff on US items: Costs rise throughout US and EU, mutual welfare losses and intensified detrimental outcomes for the US. UK experiences modest commerce diversion advantages.

US world tariff: Extreme world commerce contraction and substantial worth hikes considerably have an effect on North American welfare and UK commerce volumes.

Full world retaliation with reciprocal tariffs: Intensive world disruption and diminished commerce flows, extreme US welfare losses, $1.4 trillion world welfare loss projected.

The complete-blown commerce warfare (state of affairs 6) would have “profound implications” for interconnected economies just like the UK.

The report says:

As a trade-dependent nation navigating post-Brexit realities, the UK stands at a crossroads. Trump’s tariffs disrupt provide chains and exports, but may open doorways for rerouting, with excessive potential for exporting way more to the U.S.

The twin-edged impacts are stark: fleeting export beneficial properties collide with vulnerabilities in crucial sectors like automotive and tech, whereas EU divergence dangers, amplified by regulatory misalignment and political mistrust, threaten its efforts in resetting the UK-EU relationship.

So whereas the UK can use its post-Brexit flexibility to mitigate dangers and leverage new commerce routes, sustained beneficial properties depend upon rebuilding EU ties and supporting a rules-based worldwide commerce order, they add.

The Monetary Occasions offered some granular predictions from the identical evaluation:

And from the mainstream USA At present:

President Donald Trump’s widening world commerce warfare has clobbered the inventory market, raised the chances of a U.S. recession and began to push up inflation for American households with the prospect of a lot steeper worth will increase forward.

Trump says the final word prize – spurring extra manufacturing within the U.S. and reclaiming the nation’s standing as a producing stronghold – will likely be definitely worth the turmoil…

Amid Trump’s tariff threats, a handful of enormous producers have stated they’ll find factories or new manufacturing within the U.S., together with Hyundai, Honda and Apple.

However commerce specialists and economists say it’s unlikely a major share of makers with abroad factories will transfer established provide chains midway all over the world below the specter of on-again, off-again tariffs whose length is unsure in a tumultuous financial local weather. People who do must grapple with extreme shortages of expert staff.

Even when a sizeable share relocated to the U.S., the variety of jobs created can be comparatively small and greater than offset by these worn out in a recession, economists say.

Additional feedback from the peanut gallery, um, Twitter:

Holy shit. Trump simply misplaced Fox Information:

The S&P 500 simply dropped greater than 1%, sliding to its lowest degree since September on account of Trump’s harmful tariffs. Nasdaq dropped 1.7%. The Dow Jones Industrial Common fell 0.3% — and Massive Tech is down throughout the board. pic.twitter.com/0wsdtlPESn

— CALL TO ACTIVISM (@CalltoActivism) March 31, 2025

NEW: China, Japan, and South Korea comply with “intently cooperate” in response to U.S. tariffs

Anybody with half a mind & a fundamental understanding of the world may see that Trump’s relentless assaults on our allies will solely isolate America & strengthen Chinapic.twitter.com/BS3ppL6BTz

— Republicans towards Trump (@RpsAgainstTrump) March 31, 2025

Notice economists usually don’t see the US Nice Melancholy as attributable to Smoot Hawley, though many will agree that the commerce restrictions made issues worse. Nonetheless:

The financial injury from the 2025 tariffs may very well be a lot extra devastating than Smoot-Hawley.

Again in 1930, imports had been 3% of GDP.

At present imports are 15% of GDP.

The financial system is 5x extra uncovered to tariffs at this time than it was 100 years in the past once we realized our lesson towards… pic.twitter.com/duwuEKtFAH

— Spencer Hakimian (@SpencerHakimian) April 1, 2025

As Lambert was wont to say, that is an excessively dynamic state of affairs. Keep tuned.