Inflation Outlook Shifting Ahead

The short-term outlook for inflation is very unsure. US tariffs may decrease eurozone inflation by lowering exports and slowing financial progress. These tariffs additionally improve the availability of products within the eurozone because the US makes it tougher to entry their market. Nonetheless, if the European Fee retaliates, it may push inflation larger since these measures act like a home tax that buyers will partly bear.

Final 12 months in March, ECB President Lagarde hinted at potential fee cuts, saying, “we’ll know somewhat extra in April and much more in June.” This 12 months, by April, she’ll have far more readability on US tariffs on European items and the EU’s deliberate response, which shall be mentioned on the April ECB assembly. This may play a giant position in deciding future rates of interest.

One concern is that the job market remains to be very tight, with hitting a file low of 6.1% in February, in line with Eurostat knowledge launched on Tuesday. For now, right this moment’s lower-than-expected inflation helps the case for an additional fee lower to carry charges nearer to impartial.

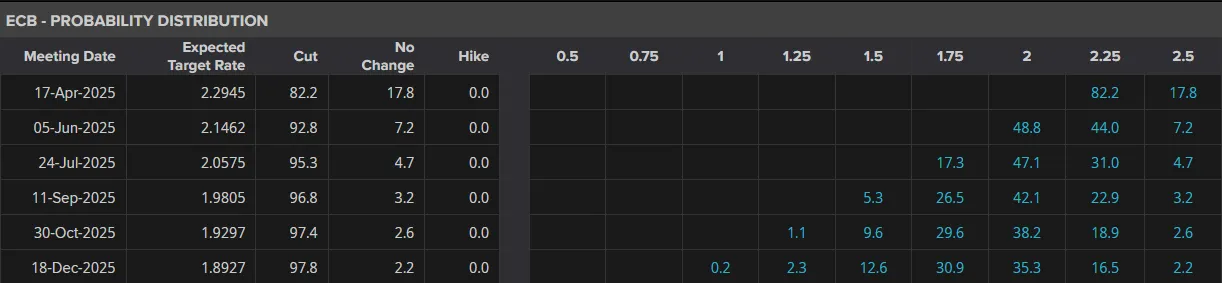

Markets at the moment are pricing in round an 82% likelihood of a 25 bps fee lower on the ECB assembly on April 17.

ECB Curiosity Charge Expectations

Supply: LSEG

Markets at the moment are bracing for ‘liberation day’ tariffs from US President Donald Trump tomorrow.

On Monday, ECB President Christine Lagarde advised France Inter radio that April 2, referred to as “Liberation Day” by Trump, needs to be a time for everybody to work collectively to take “higher management of our future” and transfer in direction of independence.

As for what to anticipate from the tariff announcement tomorrow, The Washington Submit reported on Tuesday that White Home employees have ready a plan to introduce a 20% tariff on most items imported into the U.S.

In line with the report, President Donald Trump’s group is contemplating utilizing the huge income from these tariffs to offer tax refunds or dividends. Whether or not this can work is debatable given the historical past of tariffs and their influence on international markets.

Technical Evaluation – DAX Index (DAX 40)

Taking a look at from a technical standpoint, the index has loved a stellar 2025 YTD.

Nonetheless, current technicals have instructed {that a} potential correction could also be within the offing with a possible double prime sample forming at current highs. A break of the neckline has but to materialize nevertheless, and right this moment’s weaker inflation knowledge has helped with that.

Nonetheless, a every day candle shut under the 22405 deal with (neckline) may result in an accelerated selloff within the DAX simply as President Trump prepares his tariff bulletins.

This leaves the DAX in a precarious state of affairs at current, with instant resistance resting at 22886, 23200 and naturally the current highs at 23454.

Instant help rests at 22405, 21758 earlier than the 200-day MA comes into focus at 21164.

DAX 40 Day by day Chart, April 1, 2025

Supply: TradingView.com

Help

Resistance

Most Learn:

Unique Submit