Dealmaking within the fintech sector has lagged behind sectors it as soon as bested when it comes to deal depend and funding to this point this yr. There have been solely 164 offers in Europe’s fintech sector, lower than half the 353 offers within the B2B Software program-as-a-service vertical based on knowledge collected by Sifted.

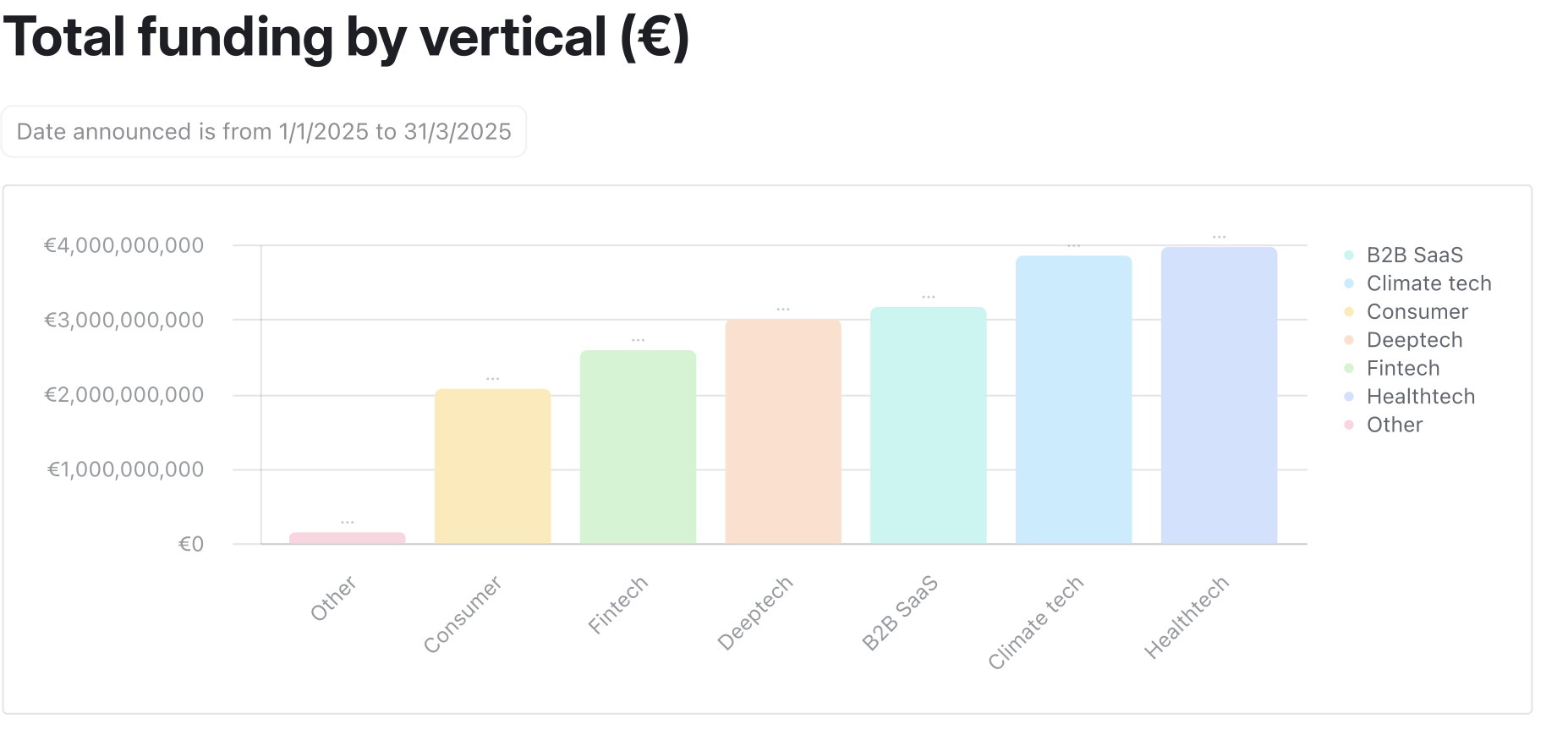

Fintech didn’t fare significantly better when it comes to whole funding both. Europe’s fintechs raised near €2.6bn within the sector throughout fairness and debt offers in comparison with the near €4bn that went to healthtech startups, which was Europe’s high vertical by whole funding final quarter. The worst-performing sector was startups targeted on the patron sector, which solely raised €2bn within the first quarter of this yr.

That’s in comparison with the primary quarter of final yr when European fintech raised €3.4bn throughout 202 offers throughout the sector. Solely climatetech raised extra at a mammoth €16.6bn because of debt rounds from the likes of Northvolt, Stegra and Enpal.

The autumn in deal depend and funding for fintech comes as lots of its bigger gamers hit profitability and forgo elevating main funding to go for secondary share gross sales. Smaller fintechs are additionally now not elevating on the funding spherical sizes and valuations of the pre-2021 interval as investor hype focuses on the buzzy du jour sectors resembling AI, local weather tech and healthtech.

That’s to not say there aren’t any vivid spots, nevertheless. In fintech, crypto, funds and wealthtech have been essentially the most energetic subsectors by deal depend, with startups in these sectors closing 93 offers between them — greater than half of the 164 offers within the quarter.

By way of funding, nevertheless, digital lending took the highest spot amongst fintech verticals with €1.1bn raised. Digital banking got here second with €391m raised, carefully adopted by crypto startups with €370m.